If you have any questions about your Business Insurance, speak to the Swinton Business team today.

Employment placement agencies

This sector continues to grow driven by the growth of contract work, while employers seek experience over potential.

Key insights

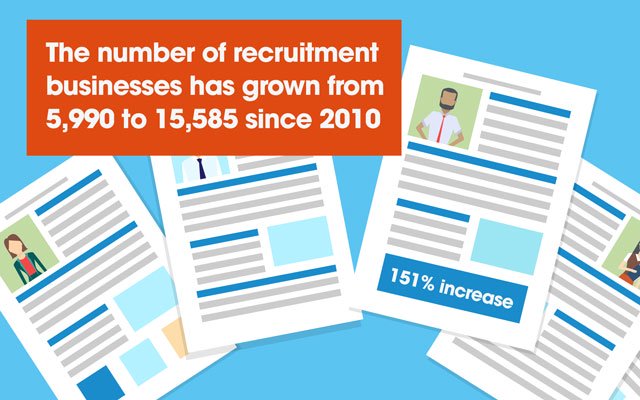

The UK’s recruitment sector has experienced an unprecedented boom since the turn of the millennium, with the number of recruitment businesses growing from 5,990 to 15,585 (a 160% increase) between 2010 and 2017.

And there’s little sign of any significant slowdown, with the ONS reporting a 14% increase in the number of businesses over 2014-15.

2016 was another strong year for the industry, with 9% growth, and recruitment is now worth £35.1bn to the economy. Over three quarters of this growth came from contract employment, with accounting, finance and heavy industry the strongest sectors.

The “gig economy” presents fresh challenges for the sector, with highly skilled workers in sectors such as advertising and public administration lured in ever greater numbers by the financial incentives offered by contract work, despite the preference of employers for making permanent hires.

Across the UK, there has been a surge in recruitment firms setting up in recent years. Perhaps unsurprisingly, London has seen the biggest increase of all, with the capital's businesses in this sector growing by 239%, from 1,485 to 5,035. In the City of London particularly, recruitment agencies have seen an even larger increase of 488%, jumping from 165 to 970, with firms focusing on placing temporary staff from the EU in various roles.

The East of England has also seen success in the recruitment field, with business numbers increasing from 585 to 1,615 – this is a 176% rise. There has been a lot of development in the region of late, including the expansion of Luton Airport, which will have created several job opportunities.

Across the UK, there has been a surge in recruitment firms setting up in recent years

Also in the East of England, the town of Braintree in Essex has seen a huge increase of 600%. This is thanks to the hundreds of new businesses setting up in the past couple of years, creating further job opportunities for people in the area. The borough of St Edmundsbury has seen similar success, with employment agencies growing by 500%. Developments to infrastructure and logistics firms in the area have resulted in more positions that need to be filled.

In the North West, the founding of MediaCityUK in Salford has seen numerous businesses opening, including the BBC and ITV, along with restaurants, bars, hotels and leisure facilities. This major development has meant that hundreds of jobs have been created, which has contributed to the overall rise of 159% in the number of recruitment businesses in the region.

More specifically in the North West, the towns of Chorley and Oldham have both seen significant increases of 300% in the recruitment sector. There has been a boom in new start-ups in Chorley, while Oldham's housing market is continuing to grow, as it

remains a more affordable option in the region for people looking to buy homes. The borough of Tameside has also seen a 300% increase in employment agencies – this also appears to have been driven by housing developments, and an increase in

demand for builders and contractors.

What does the future hold?

Challenges facing the recruitment industry over the short to medium term include automation based on advances in machine-learning and artificial intelligence, and increasingly fierce competition for talent.

With 79% of recruitment firms reporting an increase in net fee income in 2015-16, the recruitment sector is well placed to adapt and prosper, while employers will need to offer flexible benefits to attract and retain the experienced, qualified candidates they seek.

For further information on the sourced references for the Business Trends data, outside of the Business Population Estimates 2017 and Nomis official labour market statistics 2010 and 2017, please download the information here (PDF, 233MB)