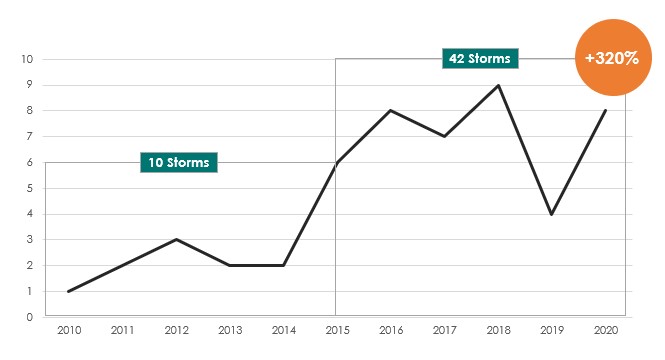

320% Increase in major UK storms

from (2010 -2014) to (2015-2020)

Usgs.gov data has recently highlighted that the increase in global temperatures will impact the intensity of storms and the possibility of more droughts in the future.

With this in mind, home insurance experts Swinton Insurance have researched into the increases of major storms over the past 10 years, revealing some significant findings.

Key Findings

320% increase in major UK storms from the years (2010-2014) [10 storms] to (2015-2020) [42 storms]

2019-2020 saw a YOY 100% increase in storms with the possibility of that increasing before the years out

£4.8 Billion in total costs of damage to the UK in the last 10 years

Total of 78 recorded fatalities in the last 10 years

Swinton Insurance states that the cost of storm damage to homes and businesses every year in the UK is at least £300 million, on average. But, in years when exceptional storms hit, the cost can be much higher. With this in mind, it’s important to storm proof your home by making sure the following advice is taken into consideration.

Check your roof for any signs of ageing, such as cracks or misaligned tiles.

Keep gutters, drainpipes and drains clear of blockages - this will ensure rainwater has somewhere to go and is less likely to build into a flood.

Check the condition of trees close to your home and consider removing any that could potentially fall onto your house or car.

Check the condition of trees close to your home and consider removing any that could potentially fall onto your house or car.

If you're in a flood risk area, consider taking out home insurance that covers you against floods and storms.

Find out more about Home Insurance from Swinton...

- Flood Risk Insurance - Flexible policies to suit a wide range of circumstances

- Combined Home Insurance - Protect your home and its contents

- Buildings Insurance - Flexible buildings cover to suit your needs

- Contents Insurance - Protect your possessions from loss or damage